Cash transfers following the birth of a first child can have large and long-lasting effects on that child’s outcomes. Andrew C. Barr and two co-authors made use of natural experiment—the January 1 birthdate cut-off for U.S. child-related tax benefits. Children born in December of previous year are eligible for tax deduction, while children born just a couple of weeks later, in January, are not eligible. As a result, families with otherwise similar children receiving substantially different refunds during the first year of life—roughly $1,300, or 10 percent of income for the average low-income single-child.

Using the careful data connection strategy, authors showed that this transfer in infancy increases young adult earnings by at least 1 to 2 percent, with larger effects for males. Baseline estimates indicate that eligibility for additional resources during the first year of life generates a $319 increase in average annual earnings between age 23 and 25 and a $456 increase between ages 26 and 28. These effects persist to older ages, with 2-3 percent increases at ages 29-31 and 32-34. These estimated effects are larger than those generated by the in-kind support programs. According to calculations, additional tax receipts associated with the increased earnings in adulthood, exceed the amount of the initial transfer, implying a negative net cost to the federal government.

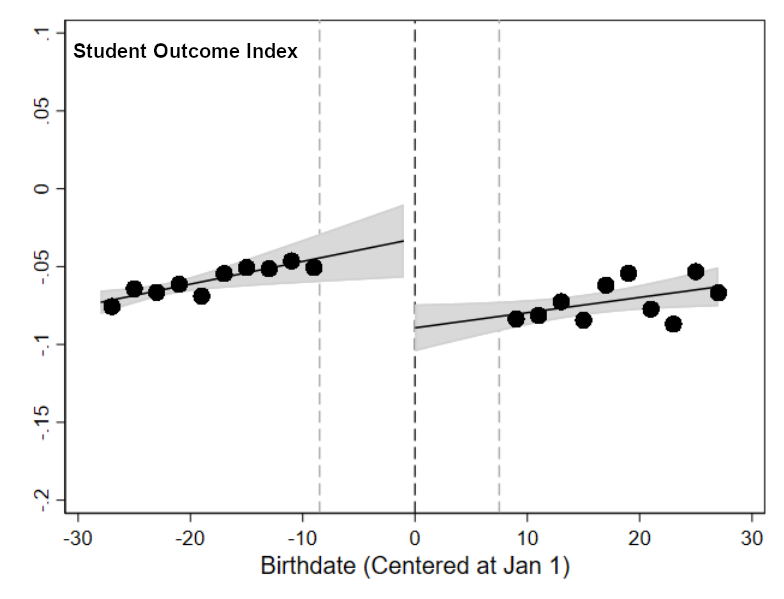

The observed earnings effects appear to be explained by earlier human capital effects. the North Carolina education data showed substantial increases in test scores, reductions in behavioural problems, and a greater likelihood of high school graduation during childhood and adolescence. This chart shows effect of cash transfer eligibility on student outcome index, constructed as the mean of normalized test scores in grade 3-8, high school graduation, and any suspension in middle or high school. Birthdates to the left of the dotted line represent those where the child’s family could have received additional resources from child-related tax benefits in the following year (if eligible based on income).

Andrew C. Barr, Jonathan Eggleston, and Alexander A. Smith (2022) “Investing in Infants: The Lasting Effects of Cash Transfers to New Families”. NBER Working Paper No. 30373, August 2022. http://www.nber.org/papers/w30373